Bitcoin: The Rise Of An Empire

This a story of how a genesis block turned into a global phenomenon.

The first cryptocurrency, iconic enough that even people knowing nothing about crypto could tell a Bitcoin at the first glance. What you’re about to read is the story of how this digital currency sparked fervent debates, revolutionized the crypto market and turned into a worldwide fever.

Here’s what I’m gonna cover in this article:

The Origin of Bitcoin

The Chronicle (2009-2023)

The Dark side of Bitcoin

Buckle up, this ride’s gonna be long!

Before you read: This article is mainly based on my own observation and research, information from various sources will be used for reference but it might contain holes and shortcomings. Read at your own discretion.

1. The Origin

Upon typing “What is Bitcoin” on Google, it’ll pretty much tell you that it’s a type of cryptocurrency, “an innovative payment network and a new kind of money.” [1] Or some sites can even give you a clearer definition of Bitcoin, which is “a decentralized digital asset. It is a new type of asset that joins the ranks of traditional assets such as cash, gold, and real estate.” [2]

So basic knowledge: Bitcoin is a cryptocurrency that acts like traditional assets such as money and gold, which can be used for trading or store of value in the Blockchain space.

Now let’s talk about how Bitcoin was born.

The first concept of Bitcoin was initiated and designed by a man name Satoshi Nakamoto in 2007. Only one year later on October 31st 2008, its father, Mr. Nakamoto, sent the first whitepaper of Bitcoin to the Metzdowd Cryptography mailing list.

The email started with:

“Announcing the first release of Bitcoin, a new electronic cash system that uses a peer-to-peer network to prevent double-spending.” [3]

And then, in the document called “Bitcoin P2P e-cash paper” [4], he described the design of a new P2P currency, quote:

“A purely peer-to-peer version of electronic cash would allow online payments to be sent directly from one party to another without the burdens of going through a financial institution. Digital signatures provide part of the solution, but the main benefits are lost if a trusted party is still required to prevent double-spending. We propose a solution to the double-spending problem using a peer-to-peer network.” [5]

In the mentioned document, he noted that this currency were made from Hashcash style proof-of-work , referring to the system which is used to limit email spam and denial-of-service attacks.

Explaining Hashcash: “The idea is that a message, like an email, "proves" that it is a legitimate message by including hashing some

stringin such a manner that it proves that a computer spent some time/energy on a particular algorithm -- in particular, computing a SHA-1 hash such that the first 20 bits of the hash are0. Because this takes a certain amount of computational time to find such a qualifying hash through brute force, it costs the sender a small amount to find the hash, which is seen as prohibitive for spammers that send large number of emails. A hashcash can be viewed as "a white-listing hint to help hashcash users avoid losing email due to content based and blacklist based anti-spam devices."This "proof of work" concept is primarily used nowadays as the bitcoin mining function. [6]

In simple words, it’s almost like when you send a letter, you’ll need a stamp for your letter to be delivered, hashcash plays as a stamp in this case. The cost of this stamp is not really considerable if you only send one, but would be quite troublesome for a spammers if he wants to sends thousands of it. And so, Bitcoin uses the similar concept to verify the miners, by requiring them to generate this “stamp” with their processors in order to get a block of Bitcoin.

In the same year, there was a forum called bitcointalk.org was created, in which Nakamoto claimed to be a Japanese, born in April 5th 1975. Other than that, we have no information about this man, some people believe the name “Satoshi Nakamoto” was actually his pseudonym on the forum. Until one day in December of 2010, the mysterious Satoshi Nakamoto stopped posting on the bitcointalk forum, only to announce that he had shifted to work on something else six months later. And then, he vanished into thin air.

Satoshi, could be anyone or a group, despite maintaining their identity hidden, is also known for their association with the cyber-activist group, “Cypherpunks.” Established by Eric Hughes, Timothy C. May, and John Gilmore in 1992, this group originally had the primary purpose of hosting casual meetings for conversations centered around cryptography. However, as time passed, the group grew significantly, expanding to several hundred members, including numerous influential figures from the computer industry.

2. The Chronicle

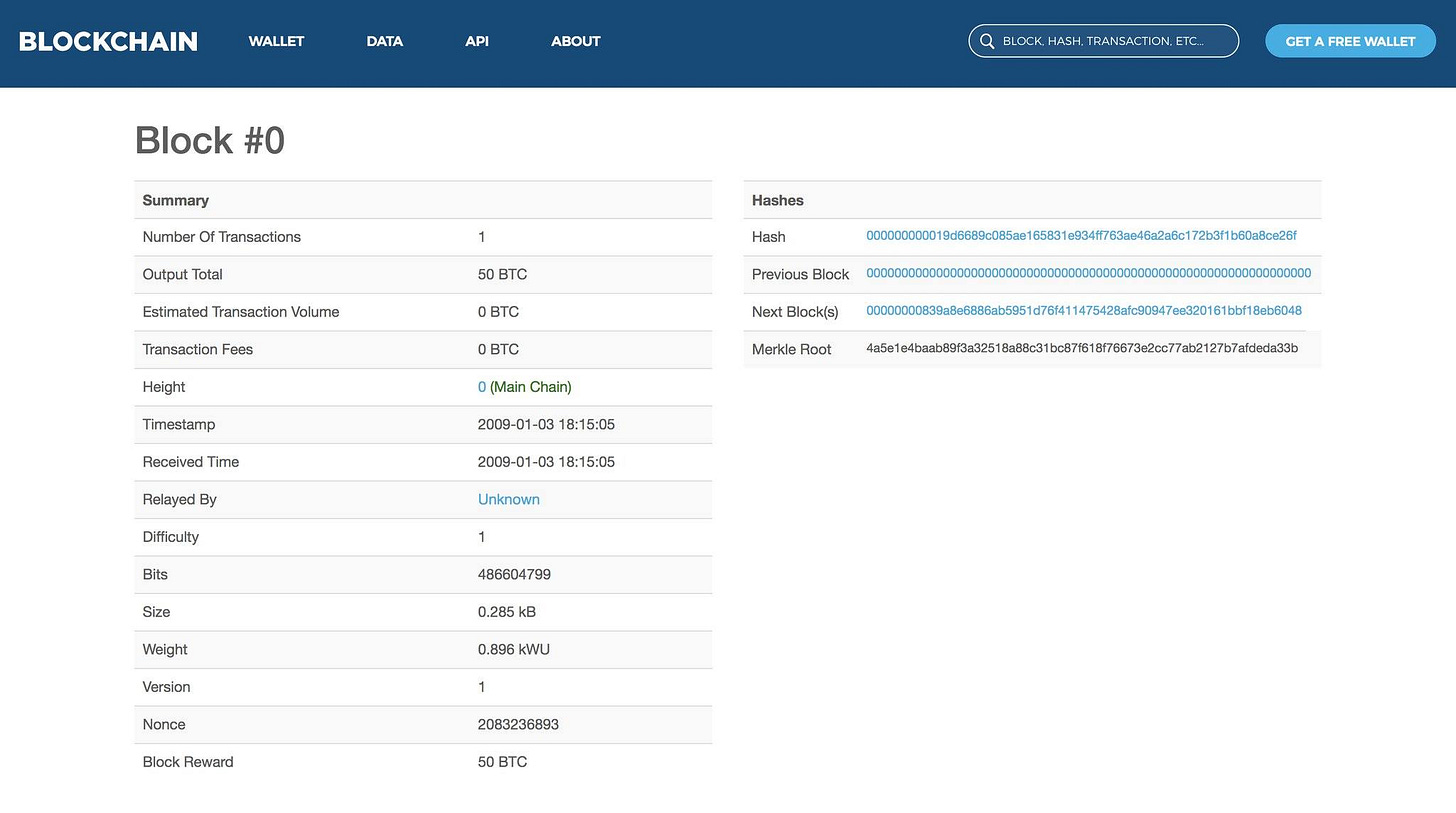

Bitcoin went live on January 3rd 2009, with the first block was mined by Satoshi himself. The first block was called “Genenis Block” or “Block #0”, consisted of 50 BTC which were worth nothing back then, but if you have that 50 BTC in 2024, that would mean you’re having roughly $310K in the palm of your hand.

One of the most interesting fact about the Genesis Block is the message hidden that was instilled in the Block’s raw data:

"The Times 03/Jan/2009 Chancellor on brink of second bailout for banks." [7]

According to the Investopedia, the message was referring to the headline of an article from the London Times about the British government's inability to boost the economy after the 2007–08 financial crisis, it looks like Nakamoto was criticizing the concept of financial institutions being deemed "too big to fail" and implying that Bitcoin would make a difference.

Many believe that Nakamoto's reference to the article in the Genesis Block's code was his attempt to signify Bitcoin's divergence from the large investment banks that required government assistance in 2008.

Six days later, Satoshi continued to mine another Block of 50 BTC, Block #1, and there he found a huge “mine” containing up to 1M BTC. In the same year, he released the source code of Bitcoin called “Bitcoin Qt” or “Bitcoin Core”.

And then the rest was history, Satoshi went “offline” since 2011 and all the BTC that he mined hasn’t been spoken about since. [8]

Fast forward to 2010, back to the time when everything was easy, especially mining Bitcoin. One year after the launch and the first Block was mined, people now could mine Bitcoin with CPU or GPU (practically using their computers at home. How convenient!)

In February 2010, bitcointalk.org the forum started to get some traction. One of the users on the platform began a thread discussing about what sort of symbol should be used for Bitcoin, in which another user recommended using the Thailand’s Bath symbol along with the “BTC” as the official currency code [9]. Most users objected the idea, saying that it might cause unwanted confusion, while some suggested using the Unicode symbols as they are recognizable yet it needed to be different from the Bath [10]. And for all that we know, the community favored the most popular idea, which was the B with two lines.

And then comes the most famous event involving Bitcoin in 2010: Two pizzas was bought with 10,000 BTC. On May 22nd 2010, a young developer named Laslo Hanyecz, who was reportedly 18 years old at the time, posted a thread on the bitcointalk.org forum, saying that he would pay “10,000 bitcoins for a couple of pizzas” and asked if anyone would join him.

And voila, several hours after in the same day, Laslo announced how his adventure turned out:

“I just want to report that I successfully traded 10,000 bitcoins for pizza. Thanks jercos!” [10]

Bitcoin price at that time was $41 when the deal was made. And so, May 22nd was remembered as the Pizza Day within the community.

In the same year, Bitcoin caught the public's attention at the end of 2010 with the launch of the Mt. Gox exchange based in Tokyo, founded by Jed McCale - Co-Founder of Stellar, allowing investors to trade bitcoin, which was priced at around 0.07 USD/Bitcoin for most of 2010, according to CoinDesk. Sadly, this world’s largest Bitcoin exchange was then attacked by hackers, losing over 90 percent of all bitcoin exchange transactions and then came its inevitable downfall in 2014.

Along with that was the introduction of the first Bitcoin mining pool, Slush Pool, was announced in November 27th 2010, and on December 13, 2010, Satoshi Nakamoto made his final post on bitcointalk.org.

The year of 2011 witnessed the emergence of other cryptocurrency, which were developed based on the source code of Bitcoin. These rival currencies are called “altcoin” as for “alternative coin”, prominently Litecoin or Namecoin were the first two altcoin to emerge.

2011 was a memorable year in Bitcoin history. In February 2011, Bitcoin once again rose and achieved "dollar parity" according to Slashdot; it hit $1.06 before settling in at roughly 87 cents [11]. Things were probably going well until several months later, several attacks aimed at Bitcoin occurred, exposing the sensitivity of cryptocurrency to price fluctuations.

The victim of the attack was an user from the bitcointalk.org forum named Allinvain. Bitcoin was relatively easy to mine back then, people could earn a couple thousands BTC from the blocks and Allinvain managed to save up to 25,000 BTC at that time. As Bitcoin price rose, his BTC turned into a treasure of $500,000. However, in June 2011, Allinvain said his computer was hacked and all his Bitcoins were transferred to the attacker's wallet. "I just woke up to see a very large chunk of my bitcoin balance gone," [12] he wrote.

If the Bitcoins were not stolen and Allinvain had kept them until now, he would have had the assets that worth $1.5 trillion as of when this article was written.

Another attack happened in August 2011, MyBitcoins, one of the famous Bitcoin wallet services back then, suddenly disappeared. The company's website claimed it was hacked and at that time, the service was storing around 150,000 Bitcoins in total. The amount "vanished" was equivalent to $1.8 million in 2011, and to $9.2 trillion in 2024.

It didn’t stop there. In 2012, a couple notorious attacks happened again, only in a much larger scale. Hackers exploited vulnerabilities in Linode hosting servers to steal at least 46,703 Bitcoins in March 2012, worth over $200,000 from multiple users. And around 43,000 of these Bitcoins belonged to Bitcoinica, an early Bitcoin exchange.

In May 2012, Bitcoinica was hacked again, resulting in the theft of 18,000 Bitcoins. An investigation followed, and users demanded compensation worth $460,000.

In September 2012, Bitcoinica was hacked once more, leading to its closure.

Bitfloor also fell victim to a hack, losing 24,000 Bitcoins valued at around $250,000. The exchange attempted to continue operating to repay its customers but ultimately had to shut down in April 2013. [13]

Moving on to the 2013-2014 period filled with even more price crashes and malicious scams. However, most people would still agree that 2013 was the year of Bitcoin. In November 2013, Bitcoin reached its peak of $1,000 for the first time, people were so thrilled at the potential of cryptocurrency, especially the Chinese.

According to the interview with Forbes, Guillaume Babin-Tremblay, executive director of the Bitcoin Embassy in Montreal, Quebec said that the recent rapid increase in the coin's value began in early October, driven primarily by increased demand from China. This heightened demand continued into November, with prices on Chinese exchanges nearly doubling compared to those on foreign exchanges.

However, as soon as Bitcoin reach its peak, the price quickly began to decline as the Chinese central bank advising against the use of bitcoin as legal tender, the cryptocurrency's price plummeted by over 50%, falling from its then-all-time high of $1,200 to less than $600.

2014 came and dropped the harshest bomb in Bitcoin history: largest crypto exchange on the planet, Mt. Gox fell victim to a malicious attack of hackers, losing over 850,000 BTC in February 2014, which worth roughly $460 million at the time. Crumbling to its knees after the attack, Mt. Gox immediately suspended its operations and filed for bankruptcy protection in Japan, where the exchange was based. [14]

And later, those who invested in Bitcoin at that time suffered heavy losses as its price plummeted to around $300. The price did not show any sign of considerable recovery for the next 3 years. [15]

Despite the odds, Bitcoin still won the year 2015. According to CNBC, the price of Bitcoin in 2015 was roughly $200 and even below that in January, it had made a good comeback, rising to $410/Bitcoin in November 3rd. Despite the doom and gloom it had been through in the previous year, CNBC and Bloomberg confirmed 2015 was the year of Bitcoin as they dubbed it “the best performing cryptocurrency of the year, netting near-40% gains, more than double its nearest competition, the Somali Shilling and Gambian Dalasi.” [16]

Mr. Brendan O'Connor, CEO of Bitcoin trading company Genesis Global Trading, believed that this recent increase in price of Bitcoin is hard to explain. According to him, there are rumors that some international Bitcoin trading networks have teamed up to push the price up, however, this rumor cannot be verified. While some others it’s Chinese uprising trend again but still, no one could confirm that either.

Meanwhile, on June 30 2015, there came an unexpected contender, the “next largest crypto network since the advent of Bitcoin”, Ethereum. The emergence of this new crypto coin, the so-called “Crypto 2.0”, promised a lot of surprises in 2016. Although a huge competitor just joined the ring, Bitcoin still ensured its top position of the Leaderboard in 2016. After two dull years, the price of Bitcoin surged over 100% in 2016, making it the best-performing cryptocurrency since 2013. The high demand had pushed the value of bitcoin from around $90 in January 2013 to hitting a record high of $1,242 that year.

Apart from the prices, the volume of Bitcoin transactions in 2016 also increased, reaching a peak of over 330 million USD per day in the summer. And so, the Bitcoin market had enough liquidity to help investors get in and out of the market without losing money, according to Hayter. [17]

To a non-crypto enthusiast and possibly outsiders, the chronicle of Bitcoin was mostly revolving around its roller-coaster price chart through the years. But it seems like that is where most of the hype comes from. Let me walk you through real quick.

The high demand for Bitcoin started to show up at the beginning of 2017, when the price of each coin surpassed $1,000. Many investors liked the idea of a decentralized currency as they were trying to find a safe haven investment similar to gold. To meet the increasing demand, two US exchanges, CME and CBOE, opened platforms for customers to trade bitcoin futures contracts. The price of bitcoin skyrocketed during the year, going from $2,000 in July 2017 to nearly $20,000 by the end of the year.

Move on to 2018, what do we have? Bitcoin price dropped as a result of Chinese central bank’s warning, as some people believed, to around $4,000 at the end of last year as investors feared the bubble bursting. But it wasn’t too low compared to what happened in 2013. At the same time, many global regulators started cracking down harder on cryptocurrency trading activities, causing prices to fluctuate wildly. By the year's end, numerous hedge funds, small investors, and large betting traders in Bitcoin suffered heavy losses as its price plummeted. [18]

2019 came and Bitcoin's price experienced a downward trend, reaching a low of $3,400 on February 8, as reported by CoinMarketCap. However, it started to rebound from that point onwards, achieving monthly gains until July 12, when it reached its peak for 2019 at $12,955. Subsequently, the market witnessed significant price volatility. Shortly after reaching its July high, the price plummeted to $9,481 by July 17, only to surge again to $12,240 by August 6. [19]

As the coronavirus hit the market in 2020, Bitcoin prices plunged 25% in March. However, at the end of 2020, Bitcoin had its second highest peak since the 1.375% increase in 2017, increasing around 160% since the beginning of the year. And for the first time since its launch, Bitcoin was officially accepted as a legal tender in El Salvador in 2021 with “with the goal of increasing investment and assisting citizens that lack access to traditional financial services” [20] and in Central African Republic in 2022.

2023 wasn’t a successful year for cryptocurrency market in general and Bitcoin in particular. BTC has lost approximately 65% of its market value in the entire year, when crypto enthusiasts thought that things could not go any worse, they found themselves in a mess: the Terra Luna crash, FTX fall and the Binance scandalous guilty plea. Quite the turbulence. But overall, Bitcoin still managed to emerge victorious as its trading price was 16,522 USD/BTC in the beginning of 2023 and at the end of the year (December 19th, 2023) it has risen to 43,076.15 USD/BTC (increasing about 250%), making Bitcoin the most profitable investment asset of the year.

3. The Dark Side of Bitcoin

Now comes the fun part. Bitcoin as well as other type of cryptocurrencies grants strong privacy to its users, which means that you can remain anonymous and untraceable while trading on the blockchain. In order to perform transactions with cryptocurrency, you will need a wallet, each wallet has a distinct string of numbers called “wallet address”.

Your transactions can only be identified by a unique alphanumeric string called a public key. People can see details of your transactions, including your holdings, trading volume and destination wallet address but they would never know the real identity behind all that numbers, assuming you did not out your wallet address in any of your social account’s bio, of course.

So, who does this anonymity favor the most? Correct, criminals. There are a lot of shady transactions incurred not in the bright daylight but in a darker part of the Internet, Darkweb. According to an article published on CoinDesk on January 29th 2024 [21], Bitcoin is still the mostly used in the ecosystem compared to other cryptocurrencies, being supported by more than 93% of markets. And where do these transactions take place? Well, there are marketplaces established just for people who wish to purchase illegal services such as money laundering, drugs, trafficking, gun-for-hire, and many more. Cryptocurrencies and especially Bitcoin are the perfect medium for these online transactions.

This part of the Internet is not something that we can get in with just a click of a mouse. What you see every day on the Internet, such as YouTube, Facebook, and Wikipedia, only represents 1-5% of the space; the remaining 95% belongs to the you-know-what. If you think Tik Tok is already offering too much of a cringe and toxic experience, Darkweb, the deepest part of the Internet, are worse by tenfold, if not a hundred.

Silk Road, Hansa or recently, the infamous AlphaBay, which is considered the Amazon of the Darkweb, has been seized by the FBI with “more than 250,000 listings for illegal drugs and toxic chemicals, and more than 100,000 listings for stolen and fraudulent identification documents and access devices, counterfeit goods, malware and other computer hacking tools, firearms and fraudulent services.” [22], yielded more than $1 billion from illegal transactions in Bitcoin and other cryptocurrencies.

“The Silk Road black market was launched in February 2011. Symbolising the “dark side” of cryptocurrency, the site used Bitcoin as a means of payment. In this case, the features of bitcoins - anonymity, ease of cross-border transactions and finality of settlement - were a perfect vehicle for criminals to conduct their illegal activities on the site.” [23]

Despite massive effort to stop the crimes from unfolding any further, the authorities still face numerous challenges to track down criminal in this part of the Internet. The collapse of these hidden marketplaces doesn’t even affect the Darkweb much, as the “clients” will just quickly move to other marketplaces in the matter of seconds once they know something went wrong.

Bitcoin as well as other cryptocurrencies and their decentralized nature are now playing an important part in keeping this dark side growing. As long as they can stay anonymous, they would continue to thrive.

Coming soon in “Mystery🔎”, we’ll take a closer look at how these hidden operations took place in Darkweb and the mastermind behind it. Stay tuned!

Introducing⭐Station Spotlight⭐ This is a new section where I would recommend a publication on related topic (or my favorites). From the next article onward, I would give a shout-out to a publication here!

Reference:

[1] https://bitcoin.org/en/

[2] https://www.bitcoin.com/get-started/what-is-bitcoin/

[3] https://finance.yahoo.com/news/10-years-ago-today-satoshi-211504089.html

[4] https://vnexpress.net/hanh-trinh-dat-dinh-67-000-usd-cua-bitcoin-4381551.html

[5] https://www.bitcoin.com/satoshi-archive/emails/cryptography/1/#selection-31.946-31.1123

[6] https://www.codeproject.com/Articles/1172340/Hashcash-or-Proof-of-Work

[7] https://www.investopedia.com/terms/g/genesis-block.asp#:~:text=Another%20puzzling%20aspect%20of%20the,mission%20statement%20for%20Bitcoin%20itself.

[8] https://genk.vn/khoi-bitcoin-dau-tien-da-duoc-dao-cach-day-tron-9-nam-va-hoi-do-no-chang-dang-1-xu-20180105090533623.chn

[9] https://bitcointalk.org/index.php?topic=41.0

[10] https://bitcointalk.org/index.php?topic=137.0

[11] https://www.wired.com/2011/11/mf-bitcoin/

[12] https://bitcointalk.org/index.php?topic=16457.0

[13] https://vnexpress.net/nhung-vu-hack-bitcoin-lon-nhat-lich-su-3681543.html

[14] https://en.wikipedia.org/wiki/Mt._Gox

[15] https://www.forbes.com/sites/bernardmarr/2017/12/06/a-short-history-of-bitcoin-and-crypto-currency-everyone-should-read/?sh=6477954e3f27

[16] https://www.coindesk.com/markets/2015/12/29/from-worst-to-first-bitcoins-price-ends-2015-on-top/

[17] https://vietnambiz.vn/thu-tang-gia-manh-nhat-2016-la-bitcoin-11258.htm

[18] https://vnexpress.net/bitcoin-khuay-dao-nam-2017-3689547.html

[19] https://decrypt.co/15656/bitcoin-price-2019-gains-investors-analysis

[20] https://rusi.org/explore-our-research/publications/commentary/too-fast-too-furious-cryptocurrency-legal-tender#:~:text=El%20Salvador%20took%20the%20step,access%20to%20traditional%20financial%20services.

[21] https://www.nature.com/articles/s41598-023-50409-5#:~:text=Although%20other%20coins%20are%20used,%25%20of%20markets7%2C9.

[22] https://www.independent.co.uk/tech/alphabay-down-reddit-what-is-it-dark-web-website-illegal-drugs-marketplace-us-justice-department-what-sold-how-big-a7851681.html

[23] https://www.bitpanda.com/academy/en/lessons/what-is-the-darknet-and-what-does-it-have-to-do-with-bitcoin/

Nice put Article Lee. I missed the opportunity to buy BTC when in 2014 when the price was at $500 at some point. Now I am going to ride the bull run.

Great article. Loved the history of the price fluctuations. I had never heard about the Chinese aspect of it. Great work!

I've done Elliot Wave analysis on the price. Its my first time. I think I calculated it would drop to $6k or $4k soon. That would be insane but we'll have to see.