sUSD And How It Rocks The Blockchain World

Not just a token that can maintain its peg to the U.S. dollar.

Hi there!

It’s been a while since I last posted anything in this category, so let’s blow the dust off of our shelves and settle down for another crypto-related article. This time, we will take a look at sUSD, the first-ever yield-bearing stablecoin on Solana created by Solayer Labs.

In this article, we’ll take a deep dive into the mechanics of sUSD, its use cases within the crypto ecosystem, and the unique features that make it stand out from other traditional stablecoins. Whether you're a crypto guru or just curious about the world of stablecoins, I hope this article can provide some valuable insights.

Let’s get started!

1. What is sUSD?

“sUSD” stands for “Solayer USD”, this token was created by Solayer Labs, a native restaking protocol on Solana.

When most stablecoins seem to stray away from the true principles of “decentralization” and deprive the investors of their promised freedom, sUSD steps into the picture and introduces itself as “a fully decentralized ” and “user-owned” stablecoin [1].

And just like that, sUSD emerged as the new generation of stablecoin on Solana.

How so? Let’s break this statement down bit by bit.

What is a stablecoin? As its name suggests, a stablecoin is a token that aims to provide a “stable” price point by being pegged to a specific fiat currency or a commodity. For example, USDC and USDT are both considered stablecoins that are designed to maintain a 1:1 exchange rate with the U.S. dollar. [2]

Since sUSD itself is a stablecoin, it works in the same ethic. However, sUSD brings something else to the world of stablecoins on Solana, which could possibly be its most remarkable competitive advantage yet: its Yield-Bearing Mechanism. Claiming to be the “first ever yield-bearing stablecoin on Solana that is pegged to the U.S. dollar and backed by U.S. Treasury Bills (T-bills),” [3] sUSD offers a 4-5% annual yield to its holders through T-Bills, which are among the most secure short-term government debt instruments.

Simply put, you can get an annual yield by just holding this token.

And it isn’t just that.

1.1. Decentralization

Surprisingly, sUSD embraces the concept of “decentralization” quite comprehensively. This aligns with the vision of an “open internet” - a digital space where financial tools are accessible to anyone, completely free from “traditional banking infrastructure,” allowing users to hold and control their assets autonomously without acquiring permission from intermediaries.

“Most stablecoins are tethered completely to traditional banking infrastructure, drifting away from crypto’s core promise of individual freedom,” Solayer Core said. [4]

This approach is also considered a novel attempt to combat the ironic limitation of traditional stablecoins, which, despite claiming to be completely decentralized, are often tied to centralized banking systems.

Solayer also confirms that sUSD is the stablecoin that appreciates a fundamental core of cryptocurrency - user ownership. Unlike other stablecoins that may be subject to freezes, blacklists, or central authority interventions, sUSD allows holders to maintain complete control over their assets, embodying the true spirit of decentralization.

“To create the ultimate open internet platform, stablecoins should be decentralized and user-owned – an automated asset that no one can create, destroy, or freeze besides the user themselves.” [4]

1.2. …And Permissionless Accessibility?

Solayer Labs, teaming up with OpenEden, has developed a system that enables everyone to mint this yield-bearing stablecoin with a minimum of $5 in USDC. This low entry requirement has pretty much shown their dedicated attempt to make tokenized assets more accessible, inviting a broader range of investors to join the market.

By introducing “Permissionless Accessibility,” the minds behind the creation of sUSD once again strengthened their belief in the need for a token that anyone can mint and truly own it.

“Built for everyone, sUSD ensures anyone can mint, redeem, or trade without restrictions, granting global access to stable, real-world assets.” [5]

This open-access model aligns well with the vision that stablecoins should be “user-owned” and free from restrictions. By allowing investors worldwide to mint, redeem, and hold sUSD without institutional barriers, this stablecoin is indeed creating an accessible and equitable environment, where the benefits of decentralized finance are truly available to all.

2. What Keeps sUSD Stable?

You might wonder how these stablecoins have their rates fixed. There are a lot of factors that contribute to their stability including but not limited to: the backing of fiat currencies; the algorithms controlling the supply; and most importantly - arbitrage trades.

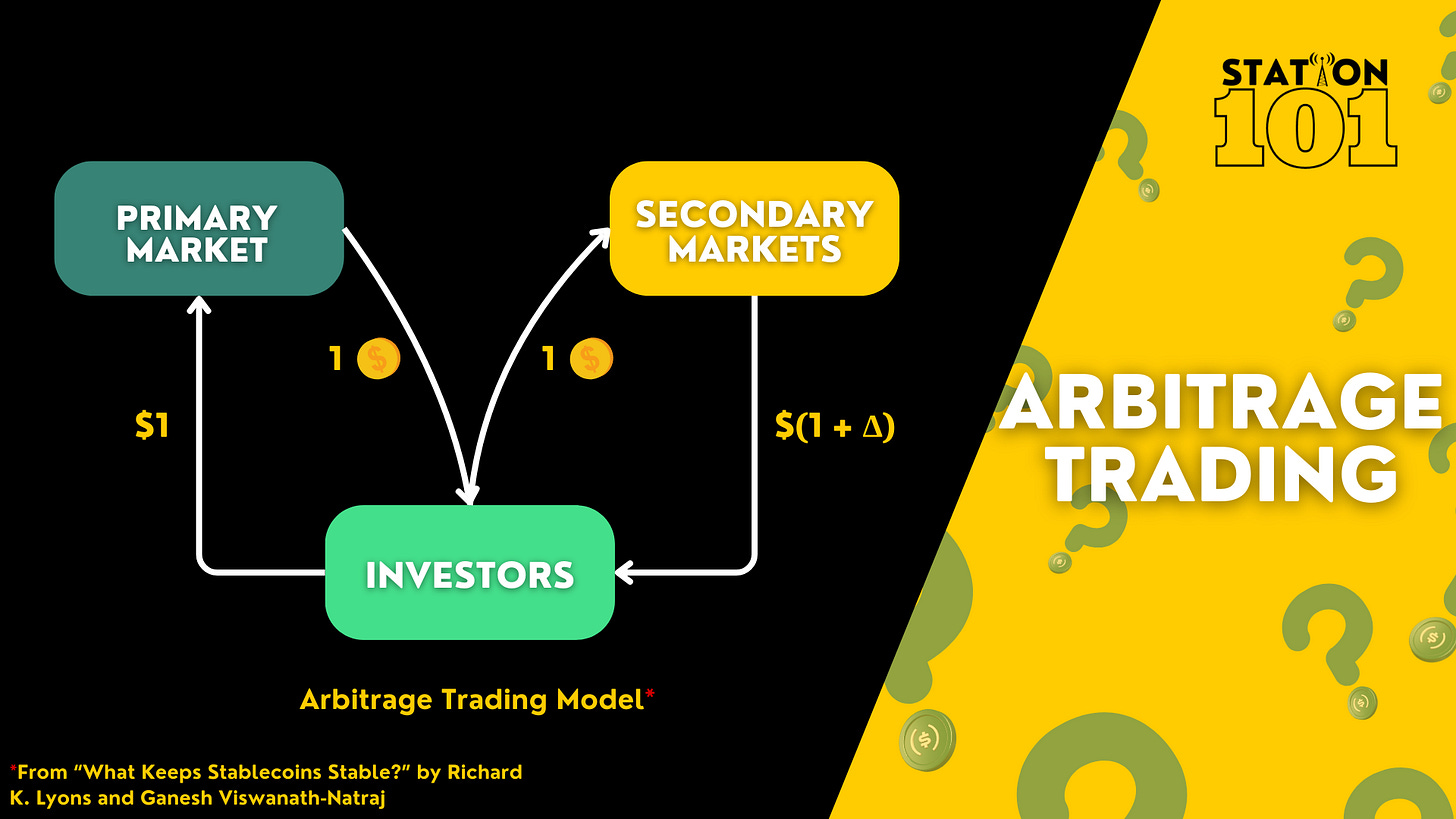

Stablecoins are typically minted on the primary market by their issuers. Meanwhile, the secondary markets - cryptocurrency exchanges, are where these coins are traded. When the price of a stablecoin in the secondary markets rises above its fixed rates in the primary market, investors see an opportunity. They can buy a stablecoin for one dollar and sell it for a higher price in the secondary markets. This action, called arbitrage trading, helps increase the supply of the coin as well as put pressure on the price, therefore, gradually pushing the price back down to one dollar.

Furthermore, the stability of these coins plays an important role in encouraging investors to adopt them in regular transactions [6].

In this case, apart from the obvious factors that secure its stability, sUSD differentiates itself from other traditional stablecoins by implementing Real-World Asset (RWA) Backing and the RFQ Mechanism.

2.1. Real-World Asset (RWA) Backing

One of the main factors that keeps Solayer’s sUSD stable is the fact that it is backed by U.S. Treasury Bills, a “low-risk” asset approved by a qualified tokenizer.

By having T-Bills as one of its first assets onboarded, sUSD appears to be highly appealing to conservative investors who are on the lookout for a safer vehicle within the cryptocurrency landscape. Furthermore, this seemingly strategic move also enables its holders to earn a passive income from the token, turning itself into a crypto version of a government bond that lives on Solana.

Who knows, soon, we might witness more real-world assets onboarded as sUSD keeps on expanding, Solayer has already shown its ambitions of adopting more low-risk commodities, quote:

“We will eventually onboard other low risk real world instruments, such as oil, gold, etc.” [7]

Additionally, unlike traditional stablecoin owners who hold T-Bills, Solayer guarantees that the annual yield from holding sUSD will be directly transferred to the holders in USDC through automatic balance updates. This distinguished feature appears to encourage investors to treat sUSD as their trusted and effortless on-chain savings account.

2.2. RFQ (Request for Quote) Mechanism

Being the crypto version of a government bond as it is, sUSD implements a decentralized, non-custodial Request for Quote (RFQ) protocol to simplify how the holders can earn yields from T-Bills.

This protocol includes two processes: subscription and redemption (simply put, deposit and withdraw). Here’s how each process works:

Subscription process [8]:

In order to mint sUSD tokens, a user is required to lock an amount of USDC as their collateral to create a quote, the user can also set the amount of USDC deposited, expiry time, and commission rate during this stage.

The locked USDC tokens will then be sent to the Decentralized T-Bill RFQ Protocol to initiate the transaction. The Protocol matches the user’s USDC with a Qualified Liquidity Provider (QLP), who will fulfill the buy order by transferring the equivalent amount of tokenized T-Bill, also known as the wrapped T-Bill, as proof of backing.

The wrapped T-Bill will be forwarded to the Solayer sUSD Program, where sUSD tokens will be minted at a 1:1 exchange rate with the US dollar. The amount of sUSD minted will be determined based on the value of the wrapped T-Bill.

Finally, the user should receive their sUSD tokens through their wallet. They can delegate their sUSD to modular services running in parallel to Solana, also known as Exogenous Asset Vault Systems or ExoAVSs. These ExoAVSs include a range of decentralized infrastructures, such as oracles, cross-chain bridges, network extensions, and rollups, which rely on user participation for security. By delegating their sUSD to these systems, holders can earn additional yield beyond the T-bill-backed returns, making sUSD a stable investment and a flexible asset that supports and benefits from the broader Solana ecosystem. [9]

Redemption Process [10]:

Now the user wishes to redeem their initial USDC tokens that are being locked. In order to do so, they can just simply return their sUSD to the program.

The next steps should unfold similarly to the Subscription Process, but backward: The Solayer sUSD Program calculates the value of wrapped T-Bills equivalent to the withdrawal request ➡️ The calculated value will then be forwarded to the Decentralized T-Bill RFQ Protocol ➡️ The wrapped T-Bills will be sent to the LQP, who will transfer the corresponding amount of USDC back to the Protocol.

Once the process is finished, the USDC tokens will be returned to the user.

3. What To Do With sUSD?

Now that we have quite an understanding of sUSD and the technology behind it, let’s delve into the practical application of this innovative stablecoin within the Solana ecosystem.

a. A Savings Account

Being the first yield-bearing stablecoin backed by U.S. Treasury Bills on Solana, it’s obvious that Solayer has a greater plan for sUSD rather than just being a stablecoin.

Unlike traditional stablecoins that simply hold value, users can hold sUSD as a stable and safe alternative to a savings account, earning passive income without needing to opt in riskier investment options.

“The token amount is then calculated by multiplying the scale with the actual holding amount. This allows the amount of sUSD in a wallet to increase natively, much like the balance in a bank account grows with interest.” [3]

b. For Collateral and Trading

sUSD’s stability and yield-bearing feature make it an undeniably reliable asset for investors in the Solana ecosystem.

A stable collateral such as sUSD might come in handy especially when investors are seeking to secure loans or leverage their positions without the constant fear of sudden changes in value, which is a common risk with more volatile cryptocurrencies.

“This allows DeFi protocols to offer more favorable borrowing conditions and lower interest rates when sUSD is used as collateral, as the risk of liquidation due to price volatility is reduced.” [3]

c. A Payment Method

Apart from its role in being a reliable asset for collateral and trading, sUSD is also designed to facilitate decentralized payments, fitting Solayer’s vision of a token for an “open internet.”

Unlike other stablecoins, a “bankless” supporting token such as sUSD doesn’t rely on traditional banking infrastructure, which favorably enables users to perform borderless transactions. This also encourages the adoption of sUSD in everyday transactions within not only the crypto but also the real-world economy.

4. Conclusion

Needless to say, sUSD should be the new embodiment of “true decentralization” in the realm of stablecoins.

A stablecoin that steps out of its border to finally deliver the promised “financial freedom” that most stablecoins failed to do the same, sUSD might be the solution for investors who are finding their next “safe haven” in the crypto world.

However, sUSD still has a long way to go, especially when its launch was only a few weeks ago (as of the time of this article). There’s nothing to say for certain, but in terms of the near future? Solayer will soon introduce its upcoming features regarding the functionality of exogenous AVSs as well as other decentralized services associated with sUSD.

Could this be the next successful colossus after Bitcoin? We’ll see.

Note: This article is for informational purposes only and should not be considered financial advice.

Readers are encouraged to complement this research with updates from trustworthy sources in order to fully understand how sUSD works and its future course.

Reference:

[1] https://solayer.org/resources/blogs/susd-the-first-rwa-backed-synthetic-stablecoin-to-secure-the-open-internet

[2] https://www.investopedia.com/terms/s/stablecoin.asp

[3] https://docs.solayer.org/susd/what-is-susd

[4] https://cryptonews.com/news/solayer-launched-susd-real-world-asset-backed-stablecoin-on-solana/

[5] https://www.linkedin.com/posts/solayer-labs_unveiling-susd-the-first-rwa-backed-synthetic-activity-7257030923622219777-pqCi/

[6] https://www.coinbase.com/fr-fr/learn/crypto-basics/what-is-a-stablecoin

[7] https://solayer.org/resources/blogs/susd-the-first-rwa-backed-synthetic-stablecoin-to-secure-the-open-internet

[8] https://docs.solayer.org/susd/decentralized-rfq/subscription

[9] https://docs.solayer.org/susd/features

[10] https://docs.solayer.org/susd/decentralized-rfq/redemption

Yay, welcome back!!

Welcome back!